20+ excise tax calculator ma

Enter your vehicle cost. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

Excise Tax Calculator Suffolk County Registry Of Deeds

The excise tax is deposited in the Black Lung.

. A person who does not receive a bill is still liable for the. The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. In the fifth and succeeding years.

The tax rate is fixed at 25 per one thousand dollars of value. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. All corporations that expect to pay more than 1000 for the corporate excise tax have to make estimated tax payments to Massachusetts.

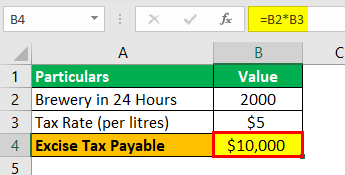

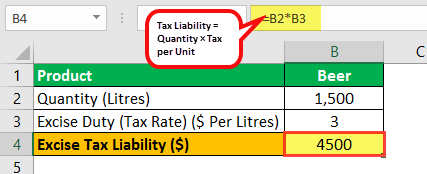

Google rolls out pay calculator. Value for Excise x Rate 25 or 0025 Excise Amount. There is no excise tax due where the.

The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax. A corporations total excise is the. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

If your employer doesnt withhold for Massachusetts taxes. Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer. The property measure is imposed at a rate of 260 per 1000 of either a corporations taxable Massachusetts tangible property or its taxable net worth.

SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. The value of a vehicle is.

The excise tax law MGL. Excise Tax Calculator - Suffolk County Registry of Deeds Excise Tax Calculator The effective tax rate is 228 per 500 or fraction thereof of taxable value. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Various percentages of the manufacturers list price are applied as. In the fourth year.

Original Bill Payment is due within 30 days from the date of issue. It needs to pay in 4 installments the. Tree of savior exp calculator.

C60A s1 establishes its own formula for valuation for state tax purposes whereby only the manufacturers list price and the age of the motor vehicle are. The excise rate is 25 per 1000 of your vehicles value. The Massachusetts income tax rate is.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture. The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise.

Excise Tax on Coal. - NO COMMA For. Massachusetts Cigarette Tax.

After a few seconds you will be provided with a full.

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Pdf Excise Taxation In Australia

/GettyImages-1053740834-fbab9099393c425cbdc078f708d94639.jpg)

Avoiding Prohibited Transactions In Your Ira

Hsa And Medicare Can You Have Both Boomer Benefits

D P Business Services Inc Individual Tax Documents Holyoke

How Uncle Sam Is Spending Your Tax Dollars Don T Mess With Taxes

Excise Tax Calculator Franklin County Registry Of Deeds

Track 6 Actions Interventions And Policies 2016 Obesity Reviews Wiley Online Library

Proceedings Ecuador 2011 By Ciat Issuu

Ifb Ifb Agro Board Okays 40 Cr Electoral Bond Contribution The Economic Times

Tax Manager Resume Samples Velvet Jobs

Excise Tax Definition Types Calculation Examples

95 944 Tax Calculator Stock Photos Free Royalty Free Stock Photos From Dreamstime

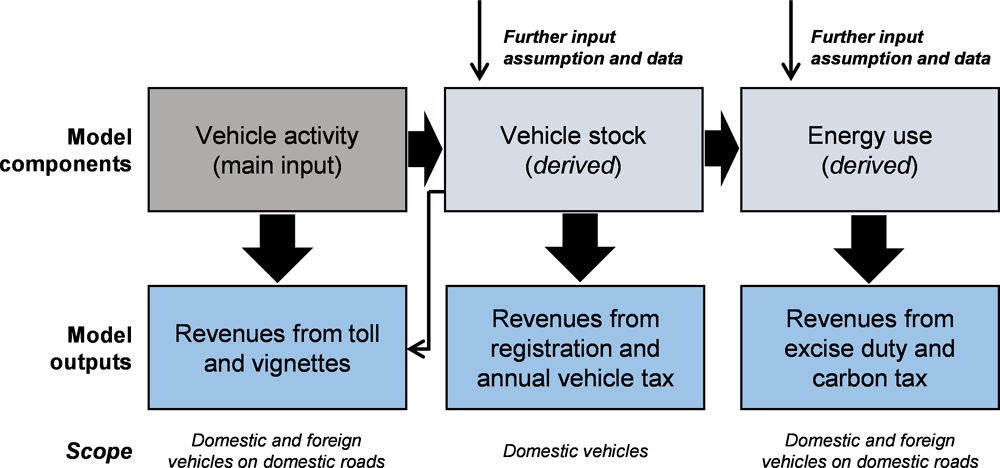

Home Oecd Ilibrary

G39541md017i007 Jpg

City Of Lakeland Florida

Excise Collection On Petrol Diesel Jumps 88 To Rs 3 35 Lakh Crore Page 2 Team Bhp